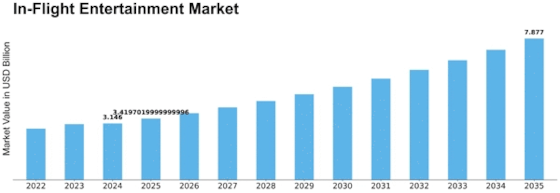

The in-flight entertainment (IFE) market has emerged as a critical component of airline strategy as carriers work to differentiate themselves in an increasingly competitive aviation sector. According to Market Research Future (MRFR), the global IFE market is expected to grow from USD 3.146 billion in 2024 to USD 7.877 billion by 2035, registering an impressive 8.7% CAGR. This growth reflects a clear industry shift: entertainment and connectivity are no longer optional but essential to airline brand value and passenger retention.

From a business standpoint, the rise of IFE investment is tied to growing customer expectations. Passengers expect high-quality content, seamless digital interfaces, and onboard Wi-Fi — trends that directly influence airline customer satisfaction scores. As competition intensifies on international routes, carriers recognize that an enriched inflight experience can significantly boost loyalty and justify premium pricing. Airlines offering advanced IFE systems often see higher net promoter scores (NPS), better repeat travel rates, and stronger brand perception.

The business case for IFE also extends to revenue generation. Modern IFE platforms allow airlines to integrate e-commerce, targeted advertising, and subscription-based services. This creates ancillary revenue opportunities that go beyond traditional in-flight sales. As digital consumption grows, airlines are exploring new commercial models, including partnerships with streaming services, gaming companies, and media providers. These collaborations ensure a steady flow of fresh content and reduce content acquisition costs.

In addition, the bring-your-own-device (BYOD) trend has reduced hardware installation expenses while enabling flexible entertainment offerings. For airlines, shifting part of entertainment delivery to passengers’ personal devices lowers maintenance needs and reduces weight, which contributes to cost savings in fuel. Many low-cost and hybrid carriers are rapidly adopting wireless IFE solutions to stay competitive without heavy capital investments.

The segmentation of the IFE market highlights several attractive areas for business growth, including hardware, connectivity, and communication systems. While hardware remains essential, the connectivity segment is expected to expand rapidly as airlines prioritize high-speed internet and real-time streaming capabilities. The adoption of satellite-based communication networks is especially important for long-haul operators looking to provide uninterrupted global coverage.

Regionally, North America leads IFE adoption due to its innovative aviation landscape and strong competition among major airlines. Meanwhile, Asia-Pacific is becoming a key business opportunity due to rising air travel demand, rapid fleet expansion, and the modernization of regional carriers.

Overall, the in-flight entertainment market offers substantial business value for airlines that invest strategically. As aviation enters a more digitally connected era, IFE will continue to shape brand competitiveness, revenue models, and the overall passenger experience. Airlines that embrace advanced entertainment technologies today will gain a clear edge in the global market moving forward.

Related Report:

Full Service Carrier Market OverView

Aerospace High-Performance Alloys Market OverView

Wide-Body Aircraft MRO Market OverView

Aircraft Engine MRO Market OverView