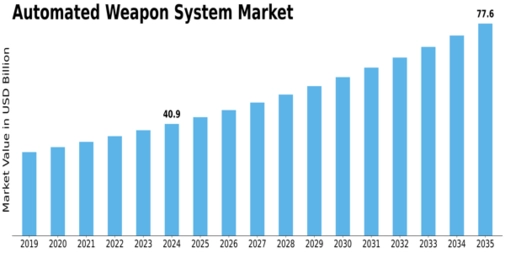

The Automated Weapon System Market is characterised not just by its overall size (USD 41.58 billion in 2024; forecast to USD 77.64 billion by 2035) but by distinct segments that offer varying growth rates and investment priorities.

Industry Overview

Automated weapon systems serve multiple domains—land, air, naval—and include diverse components (sensors, weapons, command & control, communications) and technologies (AI, robotics, machine learning). As militaries strive for autonomy, precision and operational readiness, segmentation becomes crucial to understand where budget and procurement focus lie.

Market Outlook

The forecast CAGR of 5.84 % reflects aggregated growth across segments. However, some sub-segments are expected to outpace others, making them strategic focal points for vendors and investors alike.

Segmentation Growth

Here’s a breakdown of key segments per MRFR:

- By Type:

- Land Systems: Currently the dominant segment; terrestrial platforms remain foundation of automated weapon deployments.

- Aerial Systems: Forecast as the fastest-growing type—driven by unmanned aerial vehicles (UAVs) and drones.

- By Component:

- Command & Control Systems: Largest share presently—critical infrastructure for coordination of automated weapons.

- Sensors: Fastest‐growing component segment—demand for real-time intelligence, target tracking and AI/ML analysis is rising.

- By Deployment Mode:

- On-Premises: Dominates currently—reflects defence sector’s need for secure, controlled infrastructure.

- Cloud-Based: Emerging growth mode—benefits include agility, updates and remote accessibility, though security remains a concern.

- By End-User:

- Military Sector: Major share—traditional defence buyers remain the largest.

- Defence Contractors & Government Agencies: Growing segments—these actors increasingly procure or integrate automated systems.

Strategic Implications

From a strategic standpoint:

- Vendors should emphasise sensor integration and AI capabilities, as the fastest‐growing segments.

- Firms with strong command & control offerings maintain strong current share, so incumbents have an advantage.

- The shift toward aerial systems means UAV/drones specialists have new growth windows.

- Cloud deployment models may represent the longer term opportunity—especially as defence IT policies evolve.

Final Thoughts

The segmentation analysis of the automated weapon system market Trends reveals where investment and innovation dollars are likely to go. While land systems and on-premises deployments remain dominant for now, the fastest growth pockets are in aerial platforms, sensor subsystems and cloud-enabled deployments. Stakeholders who align their product and go-to-market strategies with these emerging segment dynamics stand to capture a disproportionate share of the projected USD 77.64 billion market by 2035.

Related Report:

Airport Passenger Screening Systems Market

Air Cargo Security Screening Market